How To Use Visa Gift Card On Target

When information technology comes to Visa credit cards, the options are never-ending. At that place are Visa credit cards for all different types of people – whether you lot're a educatee, an international traveler, someone who spends a lot on amusement or food and drinks, or simply someone looking for greenbacks-back rewards. The sheer number of cards at your disposal tin can exist overwhelming. This article will highlight some of the all-time Visa credit cards offered today!

The Chase Sapphire Preferred® Card is i of the best Visa cards available, with rewards including travel and dining credits, as well as bonus points for every dollar spent. It rewards holders with 5 points for each dollar spent on travel purchases. The carte du jour also gives y'all iv points for each dollar spent on dining and two points per dollar on boosted travel purchases. Any other eligible purchases also earn you i betoken per dollar. This attribute makes it ideal as a travel Visa credit card. However, you lot need an excellent credit score between 700 and 749 to get approved for the carte du jour.

Card Details

- Gives new cardholders 60,000 bonus points if they make purchases worth $iv,000 within the get-go three months of opening an account.

- A $95 almanac fee.

- Points are worth 25% more than when y'all redeem them for travel through the Chase Ultimate Rewards program.

- Unlimited $0 delivery fees and lower service fees for eligible orders above $12.

Pros

- Gives loftier rewards on many purchases

- Allows ane:1 transfer of points to travel partners

- Offers diverse travel and shopping protection

Cons

- The card comes with a $95 annual fee

- No Apr intro offers

- Gain best rewards only when you book through Chase

ii. Chase Liberty Unlimited®

Chase Liberty Unlimited® is a Visa credit carte that offers unlimited rewards on all purchases. You'll earn a flat rate of one point per dollar, and in that location'south no limit to the number of points you can earn. Plus, you'll get a bonus of xv,000 points if you spend $500 in the kickoff three months. This card also comes with a 0% APR for the kickoff fifteen months, making it a nifty choice if you're looking to finance a big purchase. Adding up all these benefits gives you a carte to assistance you earn dorsum cash.

Carte Details

- $200 Bonus for spending $500 on purchases in the first three months later on business relationship opening.

- 5% greenbacks-back on grocery shopping up to $12,000 inside the first twelvemonth excluding Target® or Walmart® purchases.

- iii% cash-dorsum when paying restaurants, including eligible deliveries and takeout.

- 3% cash-back on purchases at drugstores.

- 5% cash-back travel purchases through Hunt Ultimate Rewards® and 1% on any other purchases.

- 0% intro APR for 15 months after opening an account with the April varying betwixt 14.99% – 24.74% afterwards that duration.

- $0 annual fees.

Pros

- No annual fee

- Can earn you up to $i,500 in quarterly rewards when you activate the 5% quarterly rewards category.

Cons

- Must make travel bookings through Chase Ultimate Rewards® to relish the v% cash-back.

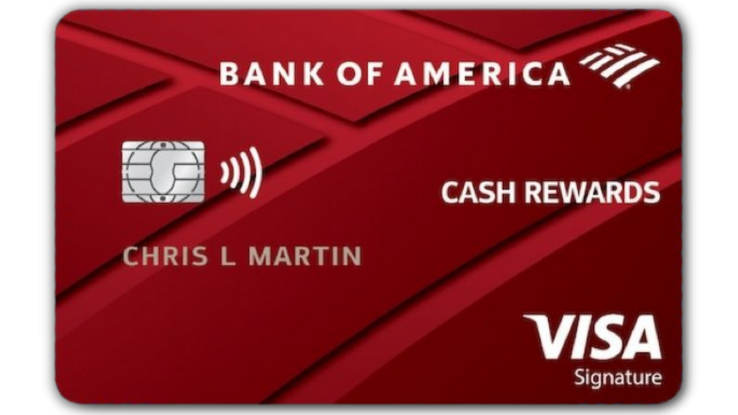

3. Bank of America® Customized Cash Rewards Credit Card

If you have an established credit history and a decent income, the Bank of America® Customized Cash Rewards Credit Bill of fare is a great Visa card to add to your wallet. Yous'll be almost guaranteed blessing with a 640+ credit score and a decent income. This Visa is a great pick for anyone who spends on gas and groceries. This Visa offers online bill of fare management, requires no annual fee, and gives you the option to get rewards when using your credit card in-store or at an ATM. It offers a cash-dorsum programme that lets yous earn 1% on all purchases, plus a bonus betwixt 10%-75% of the amount you charge per month on your Visa. The more you charge each month, the bigger the cash-dorsum percent y'all'll earn. All the same, information technology has spending limits for bonus categories, making it unsuitable for big spenders.

Card Features

- $0 annual fee

- $200 online greenbacks rewards when you spend at least $ane,000 in the showtime three months of opening the account.

- three% dorsum on a chosen category for users who spend modestly.

- 2% back on grocery stores and wholesale clubs when you spend the first $2,500 of combined bonus categories. Once you hit that limit, you earn ane% cash-back on these purchases.

- 0% Apr for the next 15 billing cycles on balance transfers and purchases, with the April beingness set for 13.99%-23.99% after this duration.

- Users can earn college reward rates if they are eligible for the Bank of America® Preferred Rewards program.

Pros

- No almanac fees

- Lengthy intro April elapsing

- Welcome bonus

Cons

- Need excellent or adept credit score

- The rewards program is complicated

- Spending limits on bonus rewards

4. United Club℠ Space Card

The United Club℠ Infinite Bill of fare is a Visa credit card that offers several benefits, including unlimited access to United Clubs and other drome lounges. The card also comes with a $525 annual fee. Yet, the fee tin be worth it if you frequently fly United Airlines and want to have advantage of the perks offered by this card. Users receive 4 miles per dollar when they purchase United and 2 miles per dollar on all other travel. You likewise receive i mile per dollar on other purchases.

Card Features

- 100,000 bonus miles once users spend $5,000 on purchases in the first 90 days of opening an account.

- $525 annual fee

- Earn iv miles for each dollar spent when purchasing United tickets, economy plus, nutrient inside the flight, Wi-Fi and beverages, and other United charges.

- Earn 2 miles for each dollar on all travel purchases, 2 miles for each dollar spent on all dining and delivery services.

- Get 1 mile for each dollar spent on all other purchases.

Pros

- No foreign transaction fee

- Benefits from the United Club

Cons

- Loftier annual fees

- No introductory APR

v. OpenSky Secured Credit Visa

The OpenSky Secured Visa Credit Card is a nifty selection for people looking to rebuild their credit. The card has no almanac fee and requires a security eolith of $200 or more. This menu as well offers a rewards plan that allows you lot to earn points on every purchase.

Bill of fare Features

- $35 annual fee

- $200 minimum eolith and a maximum of $iii,000. The card is secured, requiring users to provide a refundable security deposit that determines a user's limit.

- 17.39% variable ongoing April

- Offers no reward

- 3% foreign transaction fee

- Reports to the credit bureau significant it tin can help improve credit rating

Pros

- No credit score bank check

- No depository financial institution account required

Cons

- Annual fees

- 3% foreign transaction fee

What to Consider When Choosing Visa Credit Cards

Deciding to get a visa credit bill of fare requires diverse considerations. Some of this includes:

one. Credit score requirements

Many credit card issuers have varying credit score requirements for unlike cards. Still, they provide general guidance with credit cards requiring credit score ranges, late fees, and foreign transaction fees.

ii. Fees

A menu'south fees affect the cost. Expect into annual fees, balance transfer fees, and any other fees that could exist pegged to the card.

3. Credit card purpose

Getting the right bill of fare can depend on its intended use. Information technology can be for travel purchases, groceries, and emergencies. Understanding how you program to use the card helps you maximize rewards.

How To Use Visa Gift Card On Target,

Source: https://www.askmoney.com/credit-cards/the-best-visa-credit-cards-to-add-to-your-wallet?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex&ueid=ce587a11-18f0-4072-b6c1-1abab810fce9

Posted by: wilsonpriphy1953.blogspot.com

0 Response to "How To Use Visa Gift Card On Target"

Post a Comment